If you're considering purchasing final expenses insurance, it's important to do your research and compare different policies to find the one that's right for you. It allows you to enjoy the rest of your funds on life, knowing you've portioned away some cover for when your time is up. If your risk averse, you might feel more secure knowing that your final expenses will be covered. Ultimately, the decision to purchase final expenses insurance comes down to you.

Similarly, this provides a good opportunity to communicate the specific details of your end of life wishes, and offer support for them as well. Even if your close, it might put a strain on your family members to cover your end of life expenses. However, regardless of you relationships, it's important to have these conversations. If you have a close-knit family that is willing and able to cover your final expenses, you may not need final expenses insurance. On the other hand, if you plan to splash out all your remaining cash in life, it might be worthwhile investing a portion of your splurges into an insurance which won't leave your family burdened in your death. Your estate may be large enough to cover these costs without additional insurance. If you have a significant estate, you may not need final expenses insurance. But with an uncertain future and no knowledge of what's round the corner, t's never too early to start thinking ahead when it comes to protecting and providing for your family in the future. We get it, death it hopefully a far, far away problem at this age. If you're in your 40s or 50s, you may not see the immediate need for final expenses insurance. Here are some factors to consider when making this decision: The answer depends on your individual financial situation and personal preferences. So, do you need final expenses insurance? Ensuring your family are not left with a huge lump sum to cover everything themselves. Meaning that even if if the lump sum payment from a final expense policy does not cover all funeral expenses, memorial service and medical costs, this cover will at least provide some assistance. Whilst this policy typically has lower death benefits than traditional life insurance or a funeral insurance policy, this makes what your monthly premium payments a lot more affordable. Additionally, it can grant peace of mind for you by safeguarding your loved ones against the financial burden, stress or guilt of not being able to cover your death related expenses when you pass away. In a time of immense grief and stress, this cover can provide immense emotional and financial support to your family. They cover a wide range of costs, otherwise left entirely for your family to cover. Is final expense insurance just for funeral costs?įinal expense insurance policies are not just to cover funeral expenses.

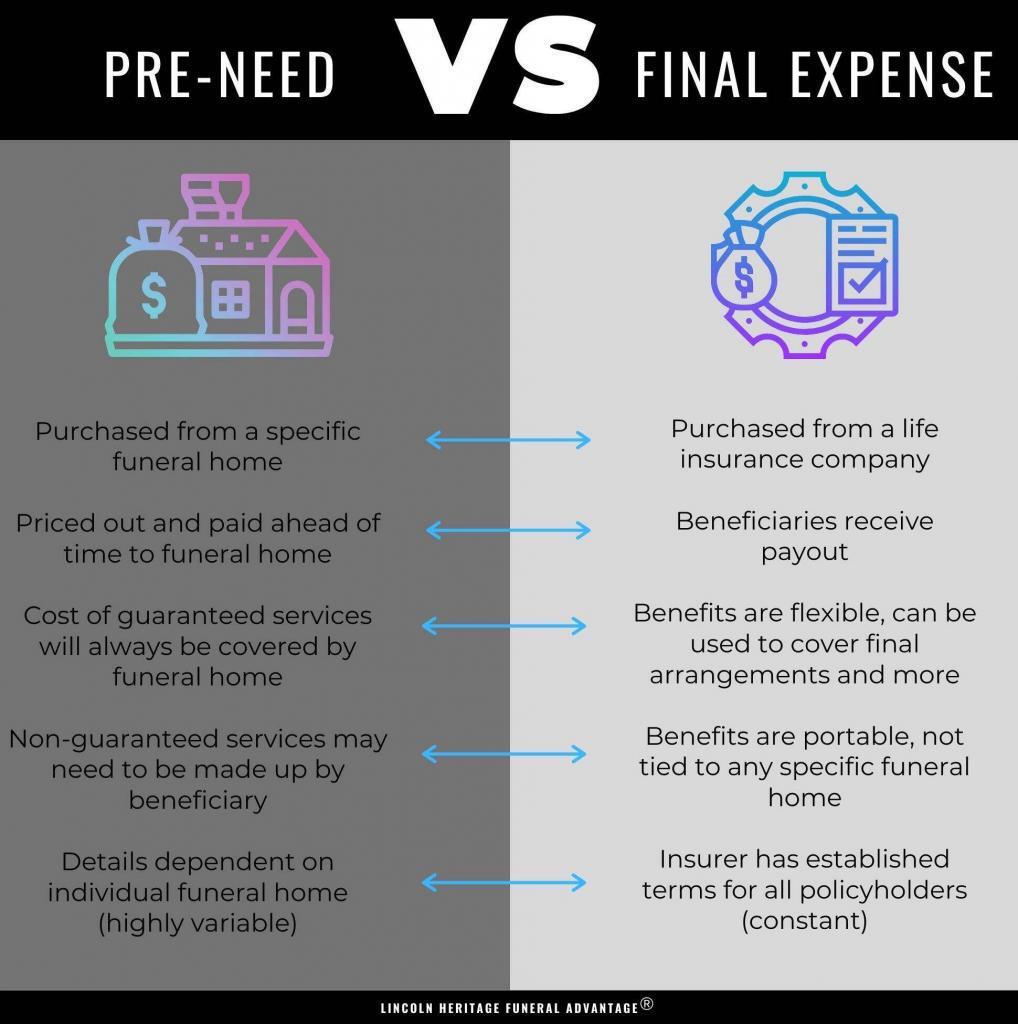

With this death benefit, premiums and accessibility consequently targeted towards an older population, sometimes excluded from other insurance policies. The difference to usual life insurance? Its eventual payout is specifically designed to cover end of life expenses. It's a form of life insurance which you pay a monthly premium for.

0 kommentar(er)

0 kommentar(er)